One of the most stressful parts of experiencing property damage isn’t just the water—it’s the “Will I have to pay for this out of pocket?” anxiety. Navigating the world of insurance claims in Oregon can feel like learning a foreign language. Between deductibles, “limitations of coverage,” and the dreaded “seepage exclusion,” many Portland homeowners find themselves overwhelmed when they should be focusing on recovery.

At 911 Restoration of Portland, we don’t just restore your home; we help you navigate the financial side of the disaster. We work with all major insurance carriers in the Pacific Northwest, and we’ve learned exactly what adjusters are looking for when they evaluate a water damage claim.

The “Golden Rule” of Insurance: Sudden and Accidental

In the insurance world, the most important phrase is “Sudden and Accidental.” Most standard homeowners policies in Portland are designed to cover events that happen without warning.

- What is typically covered: A pipe that bursts in the middle of the night, a water heater that suddenly explodes, or a washing machine hose that snaps and floods the laundry room.

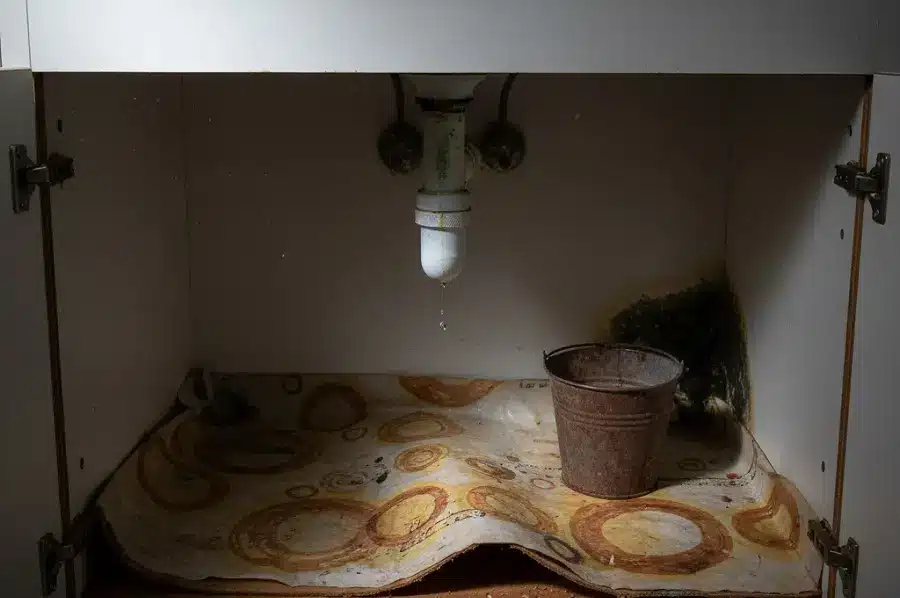

- What is typically NOT covered: A slow drip under a sink that has been happening for six months, or “seepage” through a foundation wall that occurs every time it rains. Insurance companies view these as “maintenance issues” rather than accidents.

5 Things Portland Homeowners Need to Know About Claims

- Flood Insurance is a Separate Policy: This is a major point of confusion. Standard homeowners insurance does not cover “rising water” from outside. If the Willamette River overflows or a flash flood sends a river of mud into your home, you are only covered if you have a separate policy through the National Flood Insurance Program (NFIP).

- The “Sewer and Drain Backup” Rider: Many people assume that if their sewer backs up, they are covered. However, in many Oregon policies, this is an optional add-on (a “rider”). Without this specific endorsement, a basement full of sewage might not be covered by your basic policy.

- You Have the Right to Choose Your Contractor: Your insurance company might suggest a “preferred vendor,” but by law in Oregon, you have the right to hire any restoration company you trust. At 911 Restoration, we prioritize your interests, not the insurance company’s bottom line.

- The Duty to Mitigate: Your policy requires you to take immediate action to prevent further damage. This means you can’t wait three days for an adjuster to show up before calling a restoration company to extract the water. In fact, if you don’t call for emergency extraction, the insurance company can deny your claim for “failing to mitigate” the loss.

- Documentation is Your Best Friend: The more evidence you have, the smoother your claim will go. This is why we take hundreds of photos and use moisture-reading technology to create a digital record of the damage. We provide this documentation directly to your adjuster to ensure your claim is processed fairly.

Q&A: Insurance and Water Damage

Will my insurance rates go up if I file a claim?

This depends on your history and your carrier. However, in the case of a major flood or pipe burst, the cost of the repair usually far outweighs any potential premium increase. It is almost always better to use the insurance you’ve been paying for to ensure the home is repaired correctly.

Do I need to pay my deductible upfront?

Usually, the deductible is subtracted from the total payout the insurance company sends for the repairs. You will pay the deductible amount directly to the restoration company, and the insurance company covers the rest.

What if my claim is denied?

If a claim is denied, don’t panic. You can ask for a formal “Reservation of Rights” letter explaining the denial. Sometimes, providing more evidence or having a professional restoration expert speak with the adjuster can clarify that the damage was indeed “sudden.”

Does insurance cover the cost of a hotel if I can't stay in my home?

Yes, most policies include “Loss of Use” or “Additional Living Expenses” (ALE). If your home is uninhabitable due to water damage or mold remediation, insurance will typically cover the cost of a hotel and even the extra cost of eating out.

Why did my adjuster say they won't pay for mold?

Many policies have a “mold cap”—a maximum amount they will pay for mold remediation (often $5,000 or $10,000). This is why it is so important to call us for water damage immediately; if we can dry the home before mold starts, you avoid hitting those policy limits.

Conclusion: We Speak “Insurance” So You Don’t Have To

The days following a water disaster are chaotic enough without having to fight with a claims adjuster. At 911 Restoration of Portland, we take that burden off your shoulders. We provide the professional documentation, the moisture maps, and the expert testimony needed to show your insurance company exactly what happened and why the repairs are necessary.

Don’t navigate the claims process alone. If you have water damage, call 911 Restoration of Portland at

(503) 308-7906. We’ll help you get your home restored and your claim settled, giving you a true Fresh Start.